When HMRC gives you a tax code, it’s telling your employer how much Income Tax to take out of your pay each month. It does the same thing for your pension provider, too. Once in a while, you might find your tax code changing along with your circumstances. If you see a change and don’t understand why it happened, give RIFT a quick call. We’ll check it for you and get it fixed if it’s wrong. It won’t cost you a penny, because it’s all part of the free year-round aftercare you automatically get when you claim a tax refund with us.

Your tax code is just a string of numbers and a letter. There are a few exceptions, where you’ll find yourself with an extra digit on your code, but for most people it’ll consist of:

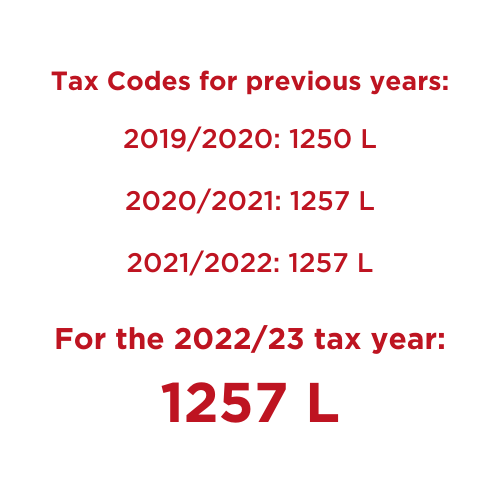

The numbers in your code explain how much money you can earn in a tax year before you start paying Income Tax on it. To get the actual figure, you multiply the numbers in your tax code by 10. So, if you’ve got a tax code of 1257L, you can earn £12,570 a year tax-free. From time to time, the Personal Allowance threshold changes, meaning the numbers in your tax code change with it.

Here’s a more complete list of the letters at the end of your tax code. If you spot a letter in your code that doesn’t make sense to you, get in touch with RIFT and we’ll sort it out.

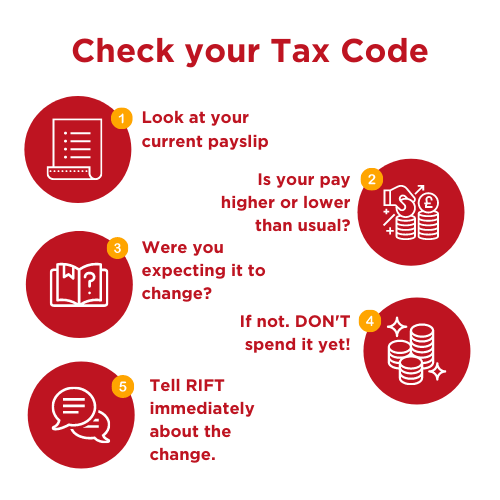

The first place you’ll want to look for your tax code is in your payslips. This is usually where you’ll notice it when your code changes – probably because you’ll find the amount you’ve been paid has changed.

For instance, when you’ve claimed a tax refund for things like your work mileage, HMRC will sometimes change your tax code so you pay less tax the next year. When they do this, they’re assuming your yearly mileage, and therefore the expenses you’re claiming tax relief for, will stay the same. The trouble is, that often won’t be the case. It all depends on how much work travel you’re doing. That’s why it’s so important to check your tax code when your payslips arrive.

If you see a change in your code, it means HMRC has contacted your employer to tell them to change the amount of tax they’re taking from your pay. If this ends up meaning you’ve overpaid your tax, RIFT will be able to sort it out for you in your next year’s tax rebate claim. However, it’s better not to stay out of pocket that long, so getting your tax code fixed fast is crucial.

If the numbers in your tax code go up after you claim a refund, you’ll be earning more cash tax-free each year, bringing your overall tax bill down. However, your expenses are likely to change over time. If they go down, for instance, while you’ll still be able to claim tax relief for them, your tax code will be using out-of-date numbers. This can lead to you owing extra money to HMRC. Again, this is something RIFT can help with, so give us a call so we can get to work. This is why we always correct your tax code as part of our aftercare service. If you spot a change in your tax code and don’t know why it happened, just let us know and we'll get it sorted.

No! There's a myth that we change your tax code after you've claimed a tax rebate with us but that's not true. We are unable to make any direct changes to your tax code, only HMRC can do that. Click the button below to read more.

It’s really important to check your tax code every year so you always know it’s correct. If your circumstances change, your tax code probably will, too – but it might not always keep up. For instance, HMRC will generally assume you’ll keep earning steadily throughout the year.

However, if you stop work part-way through a tax year, get a second job or have another source of income, your tax code might drift out of step with your situation. Keeping an eye on your tax code is the best way to make sure you don’t overpay your tax or run into trouble with HMRC.

You might need to change your tax code if you start a new job, receive additional income, or if your personal allowance changes. It’s good to keep an eye on any tax code changes. If it’s wrong, you might be taxed too much or too little.

RIFT will check your tax code automatically for you, and get it corrected if it’s wrong. This is really important, as being on the wrong tax code can lead to some serious tax headaches. When you work “on the books”, your PAYE tax code is used to calculate how much tax comes out of your pay, and how much of it is tax-free. If your code’s wrong, you’ll almost certainly be paying the wrong amount of tax.

Keep in mind that paying too little tax can actually be worse than paying too much. While HMRC is more than happy to refund you anything you’re owed (as long as you can prove it), the taxman will come down very hard on you if he finds you’ve paid less than you should. Depending on your situation, you could be looking at fines and penalties, or even a criminal record if you don’t pay up.

When RIFT claims your refund for you, our experts will conduct a Tax Code Review to check your code’s correct. If it’s wrong, we’ll get it fixed with no stress, fuss or expense for you. At the same time, we’ll look back over the last 4 years to see if you’ve paid too much tax previously. If you have, we’ll make sure you get that back too.

The thing about tax codes is that most people really only ever think about them when something’s gone wrong. They’re a mystery to most people, and problems with them will usually take an expert to fix. Being on the wrong code means you're paying either too much tax, or not enough. Either one of those is a problem that needs fixing fast. Use our tax rebate calculator to check if you’re owed an HMRC tax refund.

A P2 form (or notice of coding) is the document used by HMRC to show what tax code you’re on, and explain how it was decided. All being well, you’ll get one of these at the beginning of the tax year. As always, if you spot an unexplained or suspicious change in your tax code, let RIFT know and we’ll look into it for you. If HMRC’s made a mistake, we’ll make sure it’s fixed. If you’re confused about what your tax code actually means, we can talk you through it.

Other things to look for in your notice of coding are any work expenses or professional fees and subscriptions that have been included in your tax code. If anything’s been missed out, or included when it shouldn’t be, give RIFT a shout. We’ll make sure you never miss out and always stay on the right side of HMRC.

If you've been sent a P800 letter from HMRC, it means either:

Visit our guide for more information on what to do next.

You can end up on the wrong tax code for a few reasons, the main one being changes in your yearly work and travel expenses. These kinds of costs can change a lot over time, but once you’ve claimed a tax refund for them, HMRC will just assume that they’ll always be the same. That’s why your tax code will often change after you claim. If your yearly expenses go up or down the next year, you’ll probably be on the wrong code and paying the wrong amount of tax.

Another example might be having your tax-free Personal allowance attached to the wrong job. Every PAYE job you have comes with its own tax code. Unless you can arrange to have it split between your jobs, though, your Personal Allowance will only count for one of them. Earnings from your other job will be taxed from the very first penny you make.

Why does this matter? Well, if your “main” job brings in less money than your Personal Allowance lets you earn tax-free, then you won’t be getting the full benefit of it. You can get the overpaid tax refunded, but it’s always better to check your tax codes so you don’t end up paying too much in the first place.

Benefits in kind (BIKs) are non-cash perks provided by your employer, which are excluded from your salary or wages – things like a company car, health insurance or a gym membership. And while it’s great to receive extra benefits beyond your regular pay, it’s important to know that many of them are still subject to benefit in kind tax. This means HMRC treats them as taxable income, which could affect your tax code and monthly pay. Click the link below to learn more.

Most people who pay tax in the UK are entitled to a HMRC Personal Tax Allowance. The kind of allowance you qualify for is listed in your tax...

There may be some items in your tax code that reduce your tax-free amount and so increase the amount of tax you pay. For example if you're...

An emergency tax code is only meant to be used temporarily, until your real tax code can be worked out. However, it could result in you...

Of course you do! Get a grip on your cash with our free money saving tips, guides and videos sent straight to your inbox. What have you got to lose?

RIFTPROD1 - Subscriber