Forces Help to Buy Scheme Extended

09th March 2021

Buying a property is a big step for most people, and comes with some pretty serious challenges. If you’re in the Armed Forces, though, you could qualify for some support in the form of the Forces Help to Buy Scheme (FHTB).

Originally set up back in 2014, FHTB has recently been extended to the end of 2022. The idea is to make it less difficult to put together your initial deposit on a property through an interest-free loan amounting to as much as 50% of your Armed Forces salary. There’s a cap on the loan of £25,000, but even so it’s potentially a major leg up on the property ladder for many people.

Here are a few key points you need to know about the scheme:

- You can only get FHTB if you’re a first-time buyer, or selling your existing property. You or your family need to intend to live in the place, meaning you can’t buy-to-let. You might still be able to let the property out under certain conditions, though. However, that won’t apply until you’ve already lived in it and been moved permanently to a new duty station at least 50 miles away.

- A FHTB loan is considered a “beneficial loan” by the taxman. That means you’ll be paying tax on it if you receive more than £10,000 through the scheme (including any other beneficial loans you’re getting).

- Applying for FHTB doesn’t disqualify you from any Shared Ownership or other Help to Buy schemes you’re in. If your partner’s also in the Armed Forces, you might both be able to use FHTB to buy a place together.

- Not every mortgage lender will automatically support FHTB. Make sure you check with your provider or mortgage broker to avoid any unwelcome surprises.

- As far as paying back the loan goes, your monthly repayments will be spread over 10 years. You won’t necessarily have to start paying straight away, though. You can decide to kick off your repayments after 6 months instead, or in your last 10 years of service. Ideally, you should pay off the entire sum before you leave the Forces, but if that’s not possible you can keep up your monthly repayments after.

- 0% interest on your FHTB loan doesn’t mean zero extras in your repayments. On top of the basic monthly amount, you’ll also be paying around £6 or £7 to cover the insurance protecting your loan.

- You can actually use your FHTB loan for more than just a deposit on a new property. Self-builds are included in the scheme, along with certain kinds of home improvements or extensions on places you already own.

Pulling together a deposit on a new home is a big ask for anyone. That’s why it’s so important to make sure you’re getting back the tax HMRC owes you each year. An average Armed Forces tax refund claim comes to around £818 for a 1-year claim, which takes care of months’ worth of FHTB repayments on its own! If you've not claimed before the average first claim is around £3000 as we can claim for your work related travel and expenses for the last 4 tax years.

Remember that your tax refund isn’t some one-off bonus you grab once and forget about. This is cash you’re owed back from HMRC every year, and it vanishes straight back into the taxman’s pocket after 4 years if you don’t claim it. With a new tax year on the horizon, it’s time to get your next refund claim moving with RIFT Tax Refunds.

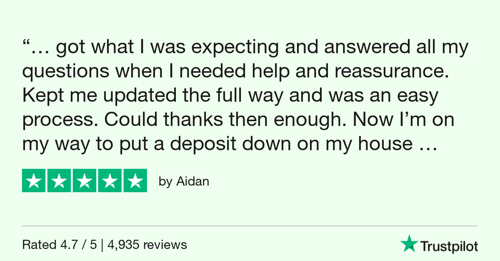

If you’ve never claimed an Armed Forces tax refund before, or just want to find out more about how it all works, RIFT is here to help. Join one of our unit briefings on Zoom to get the full picture or check a minute to check for free if you're owed a tax refund.

RIFT are the UK's leading tax rebate and tax return experts. Check out our mileage expenses calculator for instant estimate of how much tax you can claim from HMRC.