Be Like James

22nd February 2021

Remember a year back, when we introduced you to Dave, the “statistically average” RIFT Tax Refunds customer? With a monthly mileage of around 1,481 miles, Dave was travelling over 20% more for work than your typical Brit. He was spending about 59 minutes on the road for an average journey in his Ford Fiesta, had earned £150 from referring his mates to RIFT and logged into his MyRIFT account about once a month to keep his details up to date.

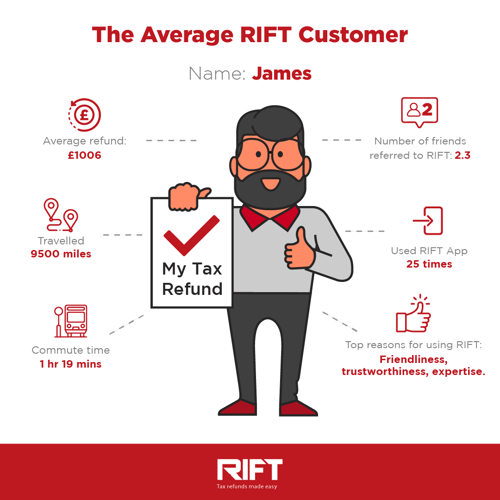

We love Dave, but time moves on - and so do the statistics he was built from. So meet James, newly evolved latest, greatest “average” RIFT customer.

- Name: James.

- James’ average yearly tax refund: £1,006.

- James’ total mileage: 9,500 miles.

- James’ daily travel time: 1 hour 19 minutes.

- Number of James’ mates he’s referred to RIFT: 2.3.

- How many times James used the RIFT app: 25.

- What James loves about RIFT: our friendliness, trustworthiness and expertise.

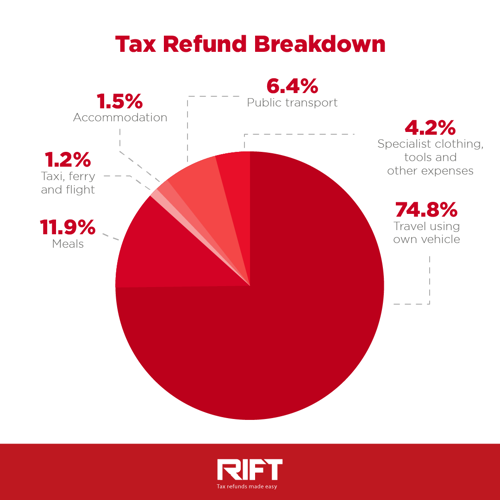

James’ tax refund and expenses probably look pretty familiar if you’re a returning RIFT customer. About 75% of his HMRC pay-out comes from his travel costs to temporary workplaces, but he also claims back a decent chunk of change for his meals on the road. He’s got expenses covering accommodation costs and upkeep of his tools and other gear as well – and he knows they’re well worth claiming for each year.

Once you get past all that, though, things start to look a bit different for James than they did for Dave. A year ago, when we first met Dave, he hadn’t even begun to feel the effects of the upcoming COVID-19 pandemic. Like a lot of people in the last year, James has had more than a few worries to deal with, which Dave never dreamed were just around the corner. James has had to deal with:

- The possibility of being put on furlough by his employer.

- Potentially changing employer – or even ditching out of PAYE work and going into business for himself.

- The risk of redundancy.

- At the very least his typical expenses have changed a lot. In some cases they’ve actually been higher, since he hasn’t been able to share equipment or split accommodation and travel bills. Those extra costs mean more cash back from HMRC in his refund claim.

Worrying times indeed – but the good news is that RIFT has James totally covered. Despite all the changes and challenges the last year has brought, James is still perfectly eligible to claim back the tax he’s owed with RIFT. When he got in touch with us this year, we were quickly able to set his mind at ease and get his refund claim rolling.

If James changed jobs, we can still get all the details needed to have his tax refunded. If he stopped “on the books” work, then we can claim back the overpaid tax he’s owed. Remember – your PAYE payments are worked out on the assumption that you’ll keep earning steadily for the whole year. If your hours or income drop, or you stop work altogether, you’ll be owed some of that cash back.

James’ biggest worry was that the pandemic might have somehow stopped him from making his refund claim – or at least made it a lot more difficult. We were really happy to be able to set his mind at ease about those things – and even happier to make sure he got back everything he was due.

So be like James. Don’t let changes to your employment or expenses trick you out of the money HMRC owes you. Log in to MyRIFT or call us on 01233 628648 to start the wheels turning on your next tax rebate claim now.

RIFT Tax Refunds are the UK's leading tax rebate and tax return experts. Use our mileage tax relief calculator to get an instant estimate of how much you could be owed on as part of your travel tax refund.