A guide to redundancy

Monday 18th July 2022

What's it all about?

This article's designed to help you:

- Understand your rights when you're made redundant

- Make sure your employer's playing by the rules

- Make the best of a challenging situation

Monday 18th July 2022

What's it all about?

This article's designed to help you:

It might not seem like much consolation when you suddenly find yourself out of a job, but a redundancy doesn’t mean you did anything wrong. That’s an important point to realise, and not just to save your own pride. Redundancies happen all the time in businesses, and the sad fact is that most of the people they affect did nothing to deserve it. It just happened that their employers needed to slim down their workforces for some reason – generally just to cut back on their overall costs. In some situations, the business might be restructuring, making certain job types less necessary. In others, the company might actually be going bust. However it happens, the end result is the same – the job you used to do just doesn’t exist any more.

Redundancies almost always come as a blow, but it’s important not to let yourself get too run down by them. It might sound like a cliché, but it’s so important to pick yourself back up as quickly as possible. Despite how it feels at first, this could be exactly the big shake-up you needed to move forward in your career – or even switch careers altogether. If you’ve been saving your pennies wisely (and following the budgeting advice in our other guides), you should ideally have as much as 3 months of your basic living costs socked away. Why not take some time to train up for the career you’ve always wanted?

Even if that’s not an option, the time to make redundancy plans is before the sky falls in, rather than after. Preparing for a big upheaval in your work life is worth a lot more than coping with it after it’s already happened. If you’ve been warned that redundancies might be coming at work, the time to act is now. You’ll be in a much better position to bounce back if the worst happens – and even if it doesn’t.

So what do we actually mean by preparation? As with so much of your other day-to-day financial planning, the first step is to take a good, hard look at what you owe. If you’re hit with a redundancy, for instance, the odds are good that you’ll wind up with a dent or two in your credit score. Lenders are going to think twice before extending you any kind of financing if you’ve taken a serious drop in your income. Now’s the time to get a firm grip on your debts, because they’re what’ll sink you if they get out of control while you sort out your work situation.

We’ve already talked about the value of having rainy-day savings. Here’s the bit that trips people up, though. When you’ve got debts racking up interest, paying off what you owe usually a much smarter move than putting savings away. The interest on a debt will almost always grow a lot faster than the interest on your savings, making you poorer over time. Using spare savings to wipe out expensive debts like credit card balances, for instance, will prevent them building up to nightmare proportions while you’re still finding your financial feet.

Read our saving strategies guide

Speaking of balances, there’s a delicate one to strike here. Yes, paying down what you owe is a smart and necessary move, before or after a redundancy. At the same time, though, you still need access to emergency cash. If you wipe out your entire rainy day stash blitzing through your debts, you’ll be risking some very hard decisions later if it takes longer than expected to land a new job.

As for specific, practical help you can get, it’s worth tackling the most important of your costs first. If you’re paying off a mortgage, for instance, you need to work out what kind of protection you’ve got to fall back on. There are schemes designed to help people through exactly this kind of situation, from both private organisations and the government itself. Search around and see if there’s one that’s a good fit for your situation.

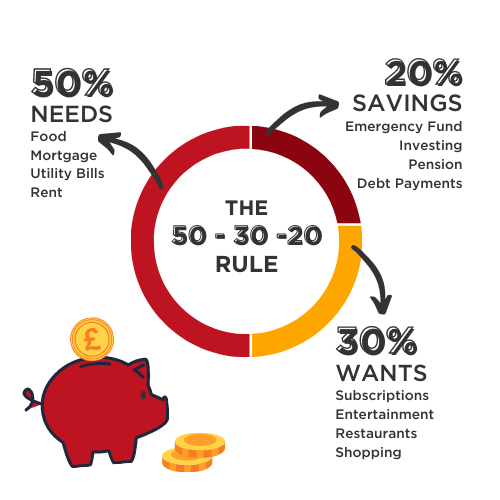

Next, go back to your budgeting basics. If you’ve read any of our articles on building budgets, you already know how much easier they make your day-to-day planning. Simple systems like the 50/30/20 rule take very little work to set up, but the pay-off can be immense over time.

When you’re working out your budget, all you’re trying to do is plug the leaks in your finances by bringing down the costs you can control while protecting the ones you can’t. Have a look through our guides for more on budgeting, and try out our free 50/30/20 tool for instant, practical help.

Okay, you’ve dealt with what you owe. Now let’s talk about getting what you’re owed. Remember, dealing with redundancy is about more than just keeping on top of your bills. It’s easy to lose your motivation along with your job – but try to remember that it’s the job itself that’s actually being made redundant, not you. We know, it sounds like we’re trying to sugar-coat it, but it’s the literal truth – and the law recognises it. That means you’ve got a surprising number of redundancy rights to fall back on. Such as:

Now’s the time to look through your contract to see what you’re entitled to. That starts with a fair selection process for which jobs are made redundant. It’s not enough, for instance, to pick the ‘winners and losers’ on a simple last-in-first-out basis. A business needs to make sure that no particular group of its employees is getting unfairly disadvantaged. You also shouldn’t be simply presented with your employer’s decision as if there were no other way. They have to show that they’ve looked into the alternatives before leaping straight to the redundancy option. Now, these other options might include a range of unappealing moves, like reducing the benefits, hours or pay of the workforce, but it’s an employer’s job to look into this stuff before simply declaring redundancies.

For one thing, you’re supposed to get some kind of consultation to discuss the situation. Beyond that, your rights should include a reasonable notice period and a certain amount of redundancy pay. Depending on the situation, you may also be offered an alternative job in the same company, and almost certainly some time off for you to look for another position. If your employer doesn’t toe the line with these rules, you might have a claim for unfair dismissal to make, or be entitled to compensation if you didn’t get an adequate consultation.

So let’s see what these kinds of rights look like in practice. When the law says the selection process needs to be fair, it’s talking about protecting you from discrimination based on things like age, gender, disability or pregnancy. If you’re picked for redundancy on the basis of your qualifications, performance or disciplinary record, for instance, then you were probably fair game. Anything else might be a reason to kick up a fuss, though.

These break down into two basic types:

If your employer has fewer than 20 people on staff, then you should get an individual consultation – and it ought to be held within a reasonable time. With 20-99 employees, the business will do the consultation on more of a ‘group’ basis. In that case, they’ll probably deal with an elected employee or union representative, assuming one’s available. Failing that, they’ll do it all individually instead. Either way, it needs to be done at least 30 days before anyone gets laid off. Companies with 100 or more workers on their books need to do collective consultations at least 45 days ahead of the first redundancy.

There are some specific laws about redundancy notice, meaning the length of time between them telling you about it and your last day of work for the business. The exact minimum notice period spends on how long you’ve worked there. Here’s how it breaks down:

There’s a cap of 12 week’s notice, meaning they don’t need to give you more time if you’ve worked there over 12 years. However, your contract may say you’re entitled to more, so make sure you check that thoroughly.

Another thing to check your contract for is any mention of ‘alternative’ notice periods. In some cases, for instance, your employer might offer you pay ‘in lieu’ of notice. That is, you could be offered a lump sum of cash instead of working out your notice. Keep in mind that this isn’t a complete windfall, though. It still counts as taxable income as normal.

Another term you might hear floating around is ‘gardening leave’. Basically, this just means you’ll continue to get your normal pay throughout your notice period, but you won’t actually have to do any work for it. Technically speaking, you’ll still be an employee during this time, though – and you could actually be called back in to work if your employer needs you unexpectedly.

Of course you do! Get a grip on your cash with our money saving tips, guides and videos sent straight to your inbox.

If you’ve been in the same job for a minimum of 2 years, you qualify for redundancy pay. You’ll have to apply for it inside 6 months from when your redundancy started, though. There are several factors that play into how much you’ll get, from your age and salary to the length of your time with the company, so let’s talk about those next.

The first thing to know is that there’s an upper limit to how much your employer needs to pay you. When they work out how long you’ve been in the job, for instance, there’s a 20-year cap on the calculations, and only complete years count toward it:

Again, though, you should always check what your contract says about this. It might turn out that you’re entitled to more.

Next, your age comes into play. For each week of redundancy pay you’re due (remember each week equates to a year of working in the same job), you can get:

Keep in mind that the redundancy pay you’re entitled to for a given year of work depends on the age you were at the time, not the age you were at redundancy. This means that different years of work could entitle you to different amounts of redundancy pay.

You’ll get your redundancy pay tax-free up to £30,000. After that, HMRC will start hacking some off in Income Tax (but not National Insurance). Whatever’s left after that will come as a lump sum payment. If you’re owed any holiday pay or pay in lieu of notice, though, that’ll all be taxed as normal.

As a quick note, because it does catch people out sometimes, just because your redundancy pay’s free of tax up to £30,000, that doesn't mean the taxman’s not interested in it. You’ll still have to report it as income to HMRC. There’s a special section in the standard tax return paperwork that covers this.

It’s quite possible that employees might be offered a voluntary redundancy deal instead of making staff cuts directly. If that happens, there’s a chance you could be able to get a better deal than the basic minimum the law or your contract specifies. Either way, make sure you understand exactly what’s on offer before making your decision.

All the same basic warnings and precautions apply to voluntary redundancies as compulsory ones. You need to be sure you’ve got enough of a financial safety net to protect you if the hunt for your next job takes longer than you’d hoped. Before taking voluntary redundancy, give some thought to the state of the industry you work in. Will you need to up your skills or retrain to land a decent replacement job? These things can take time and money.

Another thing to watch out for is whether voluntary redundancy could count against you in other ways. It might affect the types of benefit you qualify for, for example. Also, if you’ve got payment protection or other insurance policies, they might refuse to pay out if you chose voluntary redundancy. The main thing to do is think ahead. When you’re dealing with something as important as your family finances, failing to plan is the same as planning to fail.

Keep checking back here for more money tips and updates. We’re experts at saving you cash and we’re always here to help. That’s the reason why you’re better off with RIFT.

RIFTPROD1 - Subscriber